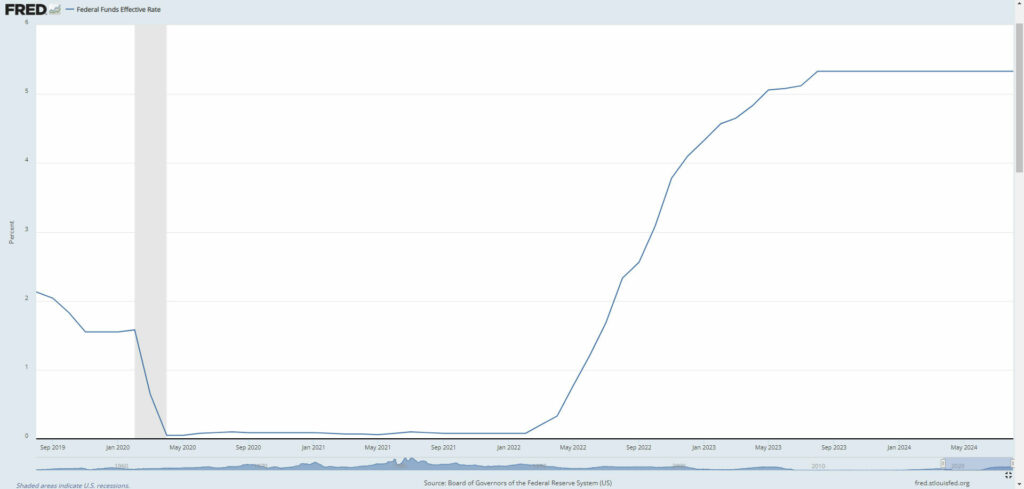

- The Federal Reserve has cut the federal funds rate for the first time in more than four years.

- This will lower the cost of borrowing, which will save car buyers money.

- Interest rates have been climbing for years and the average new car loan rate is 6.84%.

Car buyers are about to get some much-needed relief as the Federal Reserve has announced plans to cut rates by 50 basis points. This will lower the federal funds rate to between 4.75% and 5%.

var adpushup = window.adpushup = window.adpushup || {que:[]};

adpushup.que.push(function() {

if (adpushup.config.platform !== “DESKTOP”){

adpushup.triggerAd(“4d84e4c9-9937-4f84-82c0-c94544ee6f2a”);

}

else{

adpushup.triggerAd(“6a782b01-facb-45f3-a88f-ddf1b1f97657”);

} });

In a statement, the Federal Reserve said indicators suggest “economic activity has continued to expand at a solid pace” and progress has been made on inflation, although it remains “somewhat elevated.” Despite that, they conceded job gains have slowed and the unemployment rate has ticked up.

More: Average New Car Transaction Price Drops To $48k, Incentives On The Rise

Given these developments and an “uncertain” economic outlook, the Fed decided a cut was the best move. CNBC notes this is the first since 2020 and one that will benefit consumers in a number of different ways.

window._taboola = window._taboola || [];

_taboola.push({

mode: ‘thumbnails-a-mid’,

container: ‘taboola-mid-article’,

placement: ‘Mid Article’,

target_type: ‘mix’

});

window._taboola = window._taboola || [];

_taboola.push({

mode: ‘thumbnails-oc-2×1’,

container: ‘taboola-mid-article-thumbnails-organic’,

placement: ‘Mid Article Thumbnails Organic’,

target_type: ‘mix’

});

In particular, car loans should become cheaper after skyrocketing in recent years. Experian’s State of the Automotive Finance Market report revealed the average interest rate for a new car jumped from 4.61% in 2022 to 6.84% in 2024. The increase for used cars was even more dramatic as the average rate went from 8.85% in 2022 to 12.01% in 2024.

Of course, those rates can vary wildly depending on your credit score. While Super Prime used car loans averaged 7.13%, those with Subprime credit forked over an average of 18.86%. For those with Deep Subprime credit, the average rate was 21.55% which is something you’d typically associate with credit cards.

Given numbers like that, any cut is appreciated. However, don’t expect major savings as CNBC quoted Bankrate as saying a 50 basis point interest rate cut would only save new car buyers $8 per month on a $35,000 loan spread out over five years. That equates to $480 over the life of the loan or a little less than $100 per year.

var adpushup = window.adpushup = window.adpushup || {que:[]};

adpushup.que.push(function() {

if (adpushup.config.platform !== “DESKTOP”){

adpushup.triggerAd(“5646c171-cb6e-4e2c-8440-49013ca72758”);

}

else{

adpushup.triggerAd(“e7c4c913-3924-4b2d-9279-6c00984dd130”);

} });